I highly recommend the book, “The Option Trader Handbook” by Jabbour and Budwich. This book is a great resource for the “greeks” and options strategies. It is a book you read save as a reference (mostly for detailed descriptions on option trading strategies).

Brief intro to call options (I am leaving out discussion of put options):

Call options let the buyer take (or call away) 100 shares of a company at a certain price up until a predetermined date. Call options are available at a wide range of strike prices and for durations of a few days to a few years.

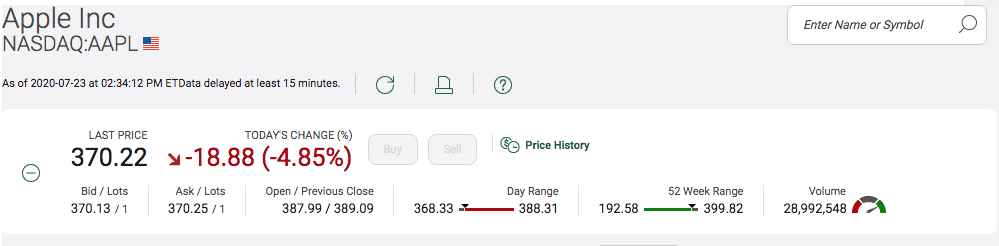

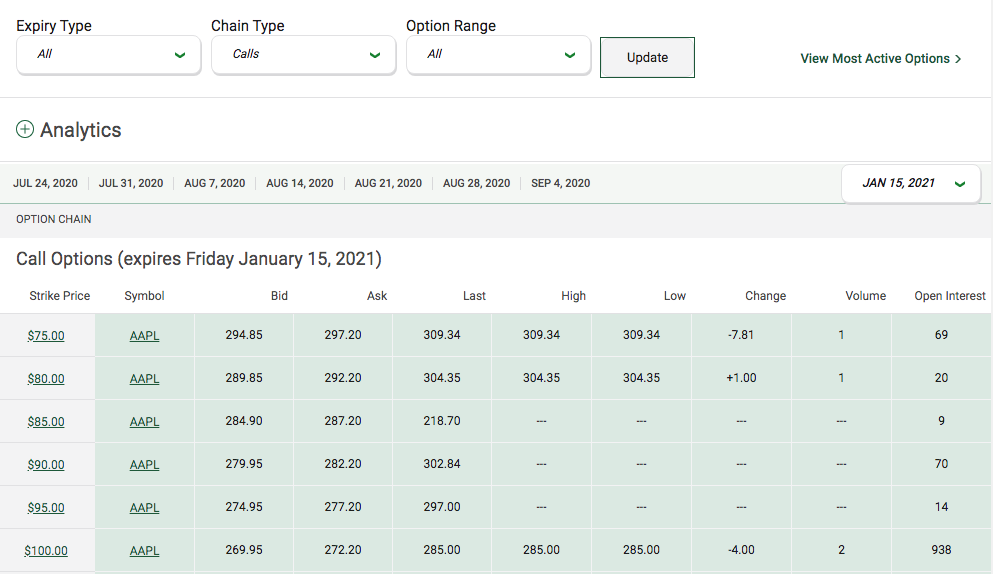

Assume it is July 1, 2020 and apple (AAPL) is trading around $365. An investor (or trader) may think apple is going to go up significantly in the fall. The stock trader could buy 100 shares of AAPL at a cost of $36,500 USD. Alternatively, an options trader could buy an AAPL 400 call expiring on January 15, 2021 for $20. The total cost of one option would be 100 shares/option x 1 option = $2,000 USD.

The option trader has purchased the right (but not the obligation) to take 100 shares of AAPL for $400 a share up to January 15, 2021, which is about 6 months into the future. If AAPL ran up to $425 in 3 months the option contract would be worth around $45 ($25 in the money and $20 for the 3 months of time left).

The strike price (the price that an option trader can buy the stock from option seller) of an options contract fits into 3 categories:

– OTM (out of the money): the options contract strick price is above the price of the stock. The option has no intrinsic value.

– ATM (at the money): the options contract is very close to the current stock price.

-ITM (in the money): the options contract strick price is above the current price of the stock. The options contract has two forms of value intrinsic value and time value.

Intrinsic value vs time premium

An options contract can have two types of value. First is intrinsic value, which is the dollar amount the current price of a stock is above the strick price of the options contract. The second type is time value. The more time there is until the option expires the more time value it will have.

Example: Apple is trading at $265. An options contract with a strike price of $250 and expiry in 3 months has a value of $25/share. This $25 is made up of $15 in intrinisic value ($265 – $250) and $10 of time value ($25 contract value – $15 that is intrinisic value).

Details on the greeks:

Theta – Time Decay – The change (drop) in the price of an options contract for the passing of one day. Options decrease in value with the passage of time. The decrease in value of an option is slower at first and but increases closer to expiration.

Delta – The sensitivity of the option to changes in stock price – How much does the options contract change in price for a $1 change in the stock price.

Gamma – The change in delta for a $1 change in stock price

Implied Volatility – IV – A measure of how large or small the typical change in the stock price is. The more volatile a stock is the more likely it could go up or down. This results in higher option prices.

Also keep an eye on the volutility of the whole market. This is measured by the VIX.

Vega – Options’ values change significantly even when the stock price is stable. This can be due to changes in IV. Vega measures the change in the option contract for a 1% change in IV. Increasing volatility will increase option prices and reduced volatility will decrease option prices.

Where to get option data

TD Options – This is where I go to get quick Bid/Ask prices on options contracts for Canadian and US public traded companies.

The TD Canada website provides Bid, Ask and last prices but does not let you know the actual value of an option contracts. (When I am lazy and want a quick guess I use the middle of the bid/ask spread).

To predict an options contract price using the “greeks” you need to use the Black Scholes formula. One of the few places I have found to look up this value (I don’t want to have to find the “greeks” values and do the math) is barchart.com.

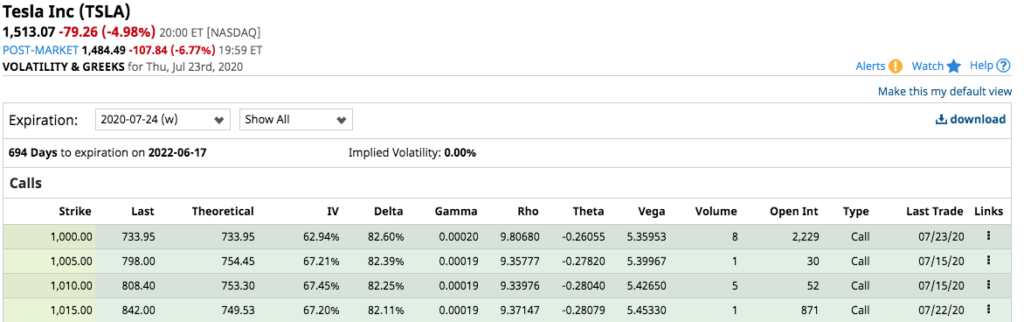

Below is a screenshot from barchart.com. This site lists delta as a % rather than a decimal. A delta value of 82.6% means that for $1 change in the stock price the option value will change by $0.826.